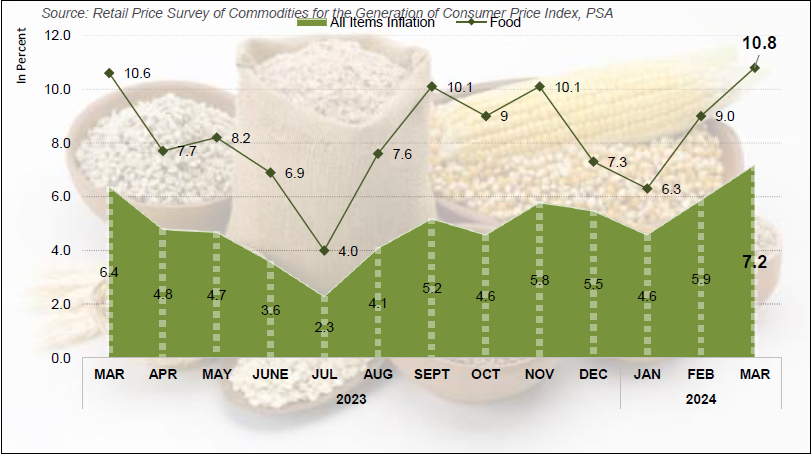

The inflation rate in Guimaras province surged to 7.2% in March, marking an increase from the 5.9% recorded a month earlier due to the rapid fluctuation in prices within various food commodity groups, which experienced a 10.8% inflation rate in March 2024 compared to 9.0% the previous month, according to the latest price data released by the Philippines Statistics Authority (PSA).

Figure 1: Inflation Rates in Guimaras (All Income Households), (2018=100),

All Items vs. Food & Non-Alcoholic Beverages: March 2023- March 2024

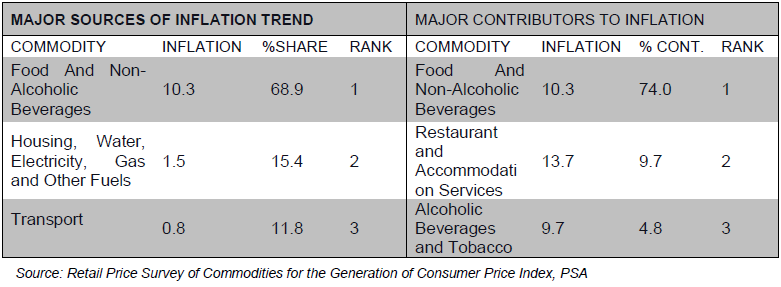

Food and Non-Alcoholic Beverages stand out as the primary drivers of the 7.2% inflation (all items) of Guimaras for March, accounting for 10.3% and a huge share of 68.9% to the inflation trend, which collectively contributed 74.0% to the overall inflation of Guimaras.

Housing, Water, Electricity, Gas, and Other Fuels with 1.5% inflation ranked two as the major cause of inflation trend chipping in 15.4% share, while Restaurant and Accommodation Services with 13.7% inflation contributed 9.7% to the March inflation.

Transport (0.8%) inflation imparted 11.8% to the trend, while Alcoholic Beverages and Tobacco (9.7%) inflation contributed 4.8% to the overall March inflation.

The 10.3% inflation of Food and Non-Alcoholic Beverages was primarily pushed by Food items, specifically Cereals and cereal products, with a 26.1% inflation, sharing 47.1% to the trend and contributing 54.2% to overall inflation.

Table 1. Top 3 major sources and contributors to Guimaras inflation rate in March 2024

The 1.5% inflation of Housing, Water, Electricity, Gas, and Other Fuels was primarily influenced by the rapid rise in electricity prices with 9.1% inflation. Similarly, the 0.8% inflation in Transport was primarily propelled by a significant price hike in gasoline, which experienced a -0.2% inflation from -7.2% a month ago.

Moreover, the 13.7% inflation of Restaurant and Accommodation Services was pushed by the fast-moving prices on Food and Beverage Serving Services with 9.5% inflation. In the same way, the 9.7% inflation of Alcoholic Beverages and Tobacco was driven by the costly retail price of Cigarettes with 11.0% inflation.

Table 2: Major share to the year-on-year inflation Trend for March 2024: All Income Households

The price statistics results also showed that among the 13 commodity groups, four of which posted a downtrend inflation from February 2024 to March 2024 (Alcoholic Beverages and Tobacco; Clothing and Footwear; Furnishings, Household Equipment and Routine Household Maintenance; and Health). See table 2

Furthermore, four of 13 commodity groups posted uptrend inflation from February 2024 to March 2024 (Food and Non-Alcoholic Beverages; Housing, Water, Electricity, Gas, and Other Fuels; Transport; and Restaurants and Accommodation Services), while five commodities showed no movement on their price indices (Information and Communication; Recreation, Sport and Culture; Education Services; Financial Services; and Personal Care, and Miscellaneous Goods and Services). See table 2

Inflation Rate is the rate of change in the Consumer Price Index (CPI) derived by computing the indices relative to the same period in the previous year or month, and currently, Guimaras Province posted a 133.0 CPI, this indicates that a typical Guimarasnon household needs 1,330.00 pesos in March 2024 to purchase a basket of goods and services worth 1000 pesos in 2018, this is 0.5 and 8.9 percent higher than the 132.5 CPI in February 2024 and 124.1 CPI in March 2023, respectively.

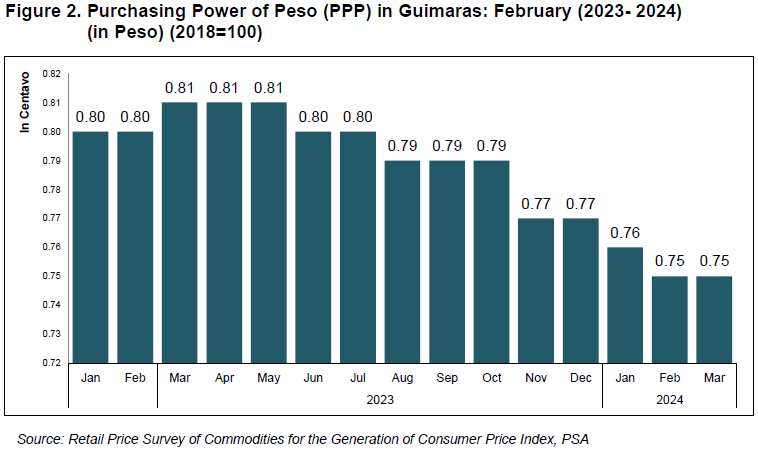

Guimaras Purchasing Power of the Peso (PPP)

The Purchasing Power of the Peso (PPP) in Guimaras remained steady at 0.75 centavos in March 2024, indicating that one peso in 2018 is now worth 0.75 centavos. The value also represented a 0.06 percentage points depreciation from the PPP value of 0.81 centavos recorded in March 2023.

The data also showed that there had been an erratic movement in the PPP in the past 13 months. From 0.81 PPP in March until May 2023, it depreciated to 0.80 centavos in June and July 2023, down to 0.79 in August, which remained steady until October and continually moved downward until the last month of 2023 with 0.77 centavos.

The PPP in 2024 started at a low of 0.76 centavo which continually slowed to 0.75 centavos in March 2024, the lowest PPP recorded for the past 13 months. See Figure 2.

DEFINITION OF TERMS

The Inflation Rate is the rate of change in the Consumer Price Index. Its formula is given by:

Where: CPI2 is the current CPI period.

CPI1 is the CPI in the previous period.

Year-on-year inflation- is the rate of change in the Consumer Price Index in a specific period of the current year relative to the same period in the previous year.

Month-on-Month inflation - is the rate of change in the Consumer Price Index in a specific period of the current month relative to the previous month in the current year.

The Consumer Price Index (CPI) is an indicator of the change in the average prices of a fixed basket of goods and services commonly purchased by an average Filipino household for their day-to-day consumption relative to a

base year. It is most widely used in the calculation of the inflation rate and purchasing power of the peso (PPP). Relative to this, daily, weekly, and

bi- monthly price surveys are conducted nationwide at the provincial offices including the District Offices of the National Capital Region (NCR) to be able to generate monthly CPI for All Income Households and CPI for the Bottom 30% Income Households. Indicators produced from price surveys are regarded as designated statistics. The seasonally adjusted CPI provides comparisons after removing the seasonal variations that may affect the series.

The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the Laspeyre’s formula with a fixed base year period (2018) weights given by:

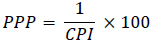

Purchasing Power of the Peso (PPP) indicates how much the Philippine Peso is worth in a given period relative to its value in a base period. It is computed by getting the reciprocal of the CPI and multiplying the result by 100 given by the equation:

Headline Inflation is defined as the rate of change in the weighted average prices of

all goods and services in the CPI basket while Core Inflation refers to the rate of

change in the CPI which excludes the following item/commodity groups: rice, corn,

fruits and vegetables, and fuel items.